Unlocking Business Growth with Effective Monthly KPI Reporting Strategies

- MyDreamFinance

- 2 days ago

- 4 min read

Most business owners do not struggle because they lack effort. They struggle because they lack visibility. Revenue might be growing, but cash feels tight. Expenses increase, yet it’s unclear why. The team stays busy, but profitability does not improve. This is where monthly KPI reporting becomes one of the most powerful tools for scaling a business.

At MyDreamFinance, we often say: What gets measured gets managed, and what gets managed gets improved. This blog post explains how monthly KPI reporting helps business owners find growth opportunities by turning raw data into clear, actionable insights.

Why Monthly KPI Reporting Matters

Financial statements tell you what happened. They show the results but rarely explain the reasons behind those results. Monthly KPI dashboards go beyond that by answering:

Why did this happen?

What is changing?

Where is the business heading?

What actions should be taken next?

This shift from historical reporting to forward-looking insight turns accounting into decision-making. Instead of waiting until year-end, business owners gain real-time visibility into:

Profitability trends

Operational efficiency

Customer behavior

Cash flow health

Growth constraints

This ongoing insight helps leaders act quickly to address problems or seize opportunities before they become obvious in traditional reports.

How Monthly Reporting Creates a Rhythm for Growth

Monthly reporting establishes a consistent rhythm of performance review. This regular check-in helps business leaders spot trends early and avoid surprises. Here are four key areas where monthly KPIs reveal growth opportunities:

1. Margin Compression Before It Becomes a Crisis

A small decline in gross margin might seem minor at first. But if it continues unchecked over several months, it can seriously hurt profitability. Monthly KPIs help identify causes such as:

Rising supplier costs and shipping fees

Increased discounting to win sales

Changes in product mix toward lower-margin items

Inefficiencies in order fulfillment or production

For example, a retailer noticing a steady drop in gross margin might discover that supplier prices increased by 5% but the sales team kept discounting heavily to maintain volume. Armed with this insight, management can renegotiate supplier contracts or adjust pricing strategies before margins erode further.

2. Customer Acquisition vs. Retention Performance

Tracking customer acquisition cost (CAC), repeat purchase rate, and revenue per customer monthly helps answer whether growth comes from loyal customers or constantly buying new ones. For instance:

If CAC rises while repeat purchases decline, the business may be spending too much on marketing without building loyalty.

If repeat purchase rates increase, it signals strong customer satisfaction and opportunities to increase lifetime value.

Monthly KPIs allow businesses to adjust marketing and customer service efforts to balance acquisition and retention for sustainable growth.

3. Cash Flow Visibility

Many profitable companies still face cash shortages. Monthly KPI reporting highlights cash flow risks by tracking:

Working capital buildup

Inventory cycles and turnover

Receivables aging and delays

Debt covenant compliance

For example, a manufacturer might see profits growing but also notice inventory levels rising faster than sales. This signals cash tied up in stock that could cause liquidity problems. Early detection allows management to adjust purchasing or sales strategies to free up cash.

4. Operational Bottlenecks

KPIs such as revenue per employee, order cycle time, and utilization rates help uncover where operational inefficiencies limit growth. For example:

If revenue per employee stagnates, it may indicate the need for training or process improvements.

Longer order cycle times could point to supply chain delays or production issues.

Monthly tracking of these metrics helps identify bottlenecks quickly so businesses can improve workflows and increase capacity.

Why Annual KPI Reviews Are Still Important

While monthly reporting provides timely insights, annual KPI reviews offer a broader perspective. They help business owners:

Confirm long-term trends and validate monthly findings

Align KPIs with strategic goals and adjust targets

Review overall financial health and market position

Plan budgets and investments based on comprehensive data

Combining monthly monitoring with annual strategic reviews creates a powerful feedback loop that supports continuous improvement and long-term growth.

Practical Steps to Implement Monthly KPI Reporting

To unlock growth opportunities through monthly KPI reporting, business owners should:

Choose the right KPIs: Focus on metrics that directly impact profitability, cash flow, customer behavior, and operations.

Automate data collection: Use software tools to gather and visualize data quickly and accurately.

Set clear targets: Define realistic goals for each KPI to track progress.

Review monthly with the team: Hold regular meetings to discuss results and decide on actions.

Adjust and improve: Use insights to make informed decisions and refine strategies.

For example, a small e-commerce business might track monthly KPIs such as gross margin percentage, customer acquisition cost, average order value, and inventory turnover. By reviewing these numbers monthly, the owner can spot rising costs, shifts in customer buying patterns, or slow-moving stock and respond promptly.

Monthly KPI reporting is not just about numbers. It is about gaining clarity and control over your business. It helps you see what is working, what is not, and where to focus your efforts for growth.

Start building your monthly KPI reporting process today. The sooner you measure, the sooner you can manage and improve your business performance.

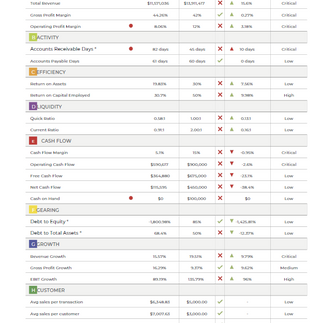

A Sample KPI Report (Demo Client)

This month, we’re sharing a sample KPI dashboard from a fictional client example to demonstrate what structured reporting can look like.

The purpose is simple:

To show how business owners can move from reactive accounting to proactive growth management.

If you’d like a KPI reporting package tailored to your business model — whether you're in e-commerce, manufacturing, services, or technology — we’d be happy to help.

Growth doesn’t come from working harder.

It comes from working with clarity.

And clarity starts with knowing your numbers — consistently, monthly, and strategically.

Interested in building a KPI dashboard for your business?

Feel free to reach out or connect with us at MyDreamFinance.